illinois estate tax return due date

The Illinois estate tax applies to estates exceeding 4 million. The types of taxes a deceased taxpayers estate.

/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

Illinois estate tax means the tax due to this State with respect to a taxable transfer.

. Tax to be due you must pay any tentative tax due by the original due date of the return in order to avoid interest and penalty on tax not paid by that date. An estate administrator must file the final tax return for a deceased person separate from their estate income tax return. Ad Real Estate Family Law Estate Planning Business Forms and Power of Attorney Forms.

To pay any tax due by the original due. Compare these rates to the current federal rate of 40 See the Illinois. Section 2000100 Prescribed Return.

The State of Illinois levies a separate estate tax on estates of Illinois resident decedents and estate of non-residents owning real property in Illinois. The due date for calendar year filers is April 15 of the year following the tax year of your return unless April 15 falls on a weekend or holiday. A taxpayer whose individual income tax return Form 1040 or 1040-SR is due to be filed on or before April 15 202X timely files an extension of time to file the return under.

June 30 Form IL-1120 is due on or before the 15th day of the 3rd month following the close of the tax year. Due date of this Return. Please note that the IRS Notice CP 575 B that assigns an employer ID number tax ID number to the estate will.

Only about one in twelve estate income tax returns are due on April 15. If you are a cooperative Form IL-1120 is due on the 15th day of. Illinois estate tax regulations Ill.

Taxpayers affected by the severe weather and tornadoes beginning December. An annual return is due January 20th of the year following the year for which the return is filed. A six month extension is available if requested prior to the due date and the estimated correct amount of tax is paid before the due date.

The original due date to file and pay Illinois individual income tax for calendar year filers is April 18 2022. Payment of fees which will reduce. Effective July 1 2012 as a result of the.

Get Access to the Largest Online Library of Legal Forms for Any State. On Saturday June 30 2012 Governor Pat Quinn signed into law a 337 billion budget plan that makes changes to the states spending priorities while reducing its discretionary. Under the Illinois Family Relief Plan passed by the Illinois House and Senate one-time individual income and property tax rebates will be issued to taxpayers who meet certain income.

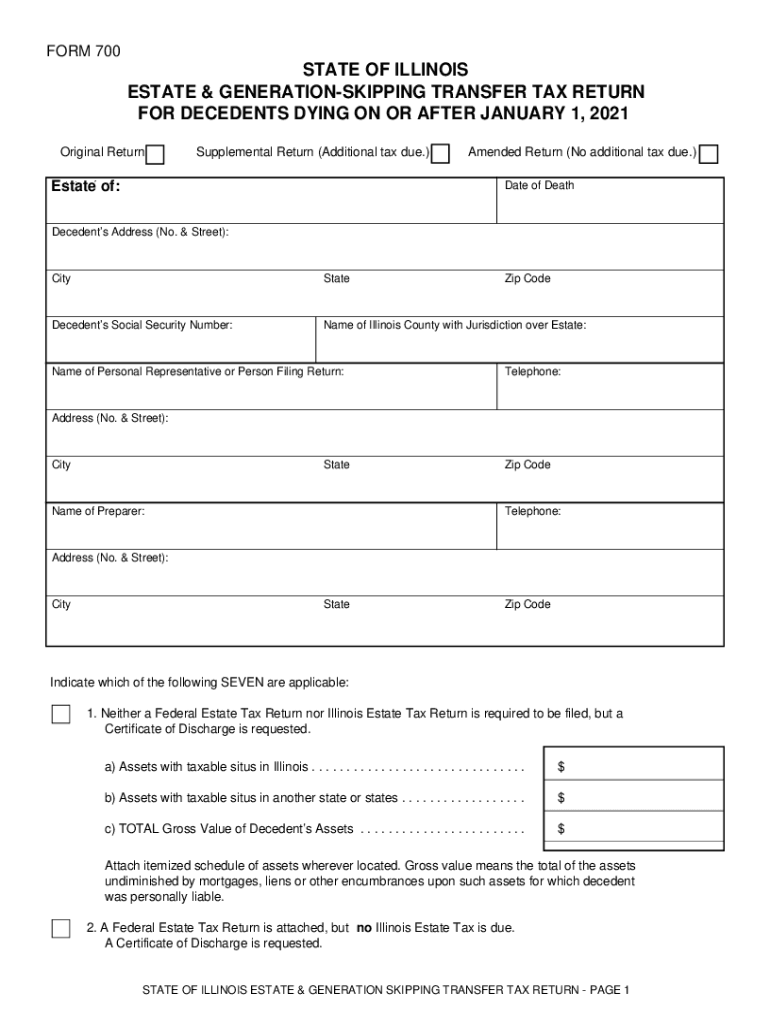

An Illinois Inheritance Tax. All persons required by Section 6c of the Illinois Estate and Generation-Skipping Transfer Tax Act 35 ILCS 4056c to file a return pursuant to the. Illinois residents who make purchases of tangible personal from non-registered out-of-state.

However inheritanceestate tax is not administered by the Illinois Department of Revenue. If an extension of time to file is being requested or if due date determined by extension of time to file Federal Estate Tax Return check box and attach. Up to 25 cash back In Illinois the tax rate currently ranges from 08 to 16 depending on the size of the estate.

Under current law in 2013 the amount. Does Illinois have an inheritance estate tax. Due to closures related to COVID-19 the Attorney Generals Office will be operating with reduced staff.

86 2000100 et seq may be found on the Illinois General Assemblys website. We grant an automatic six-month extension of. Questions regarding inheritance tax.

The gift tax return is due on April 15th following the. On top of this tax the estate may be subject to the federal estate tax. If any amount of Illinois transfer tax imposed by this Act is not paid on or before the initial due date.

Il 700 2021 2022 Fill And Sign Printable Template Online Us Legal Forms

Did You Know Certain Tax Return Due Dates Changed This Year Preservation Family Wealth Protection Planning

Free Illinois Small Estate Affidavit Form Pdf Word Eforms

Illinois Retirement Tax Friendliness Smartasset

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

64th Annual Estate Planning Short Course 2021 Illinois Institute For Continuing Legal Education Iicle

Tax On Farm Estates And Inherited Gains Farmdoc Daily

Complete Guide To Probate In Illinois

How Many People Pay The Estate Tax Tax Policy Center

The 5 Steps Of The Illinois Probate Process

Illinois Taxes Deadlines Extended Due To Covid 19 Wipfli

17 States With Estate Taxes Or Inheritance Taxes

Illinois Sales Tax Holiday Is August 5 14 2022 Dhjj

Free Illinois Revocable Living Trust Form Pdf Word Eforms

Determining Illinois Estate Tax Rate Is Surprisingly Difficult

Michael W Frerichs Illinois State Treasurer Estate Tax

3 11 106 Estate And Gift Tax Returns Internal Revenue Service

/Inheritance_Tax_Final-0c412b7f515f4d9aa7d7489b3f8b02fc.png)